投資領袖和(hé)他(tā)們的(de)思想之光(guāng)

發布時(shí)間(jiān):2022-03-18 | &nb∏€sp; σ✘ 來(lái)源: 川總寫量化(huà)

作(zuò)者:石川

摘要(yào):這(zhè)些(xiē)先行(xíng)者的(de)傑出工(♠®gōng)作(zuò)和(hé)重要(yào)貢獻塑造★✘λ₽了(le)如(rú)今人(rén)們對(duì)投資的(de)認知(§♣€zhī)。

引言

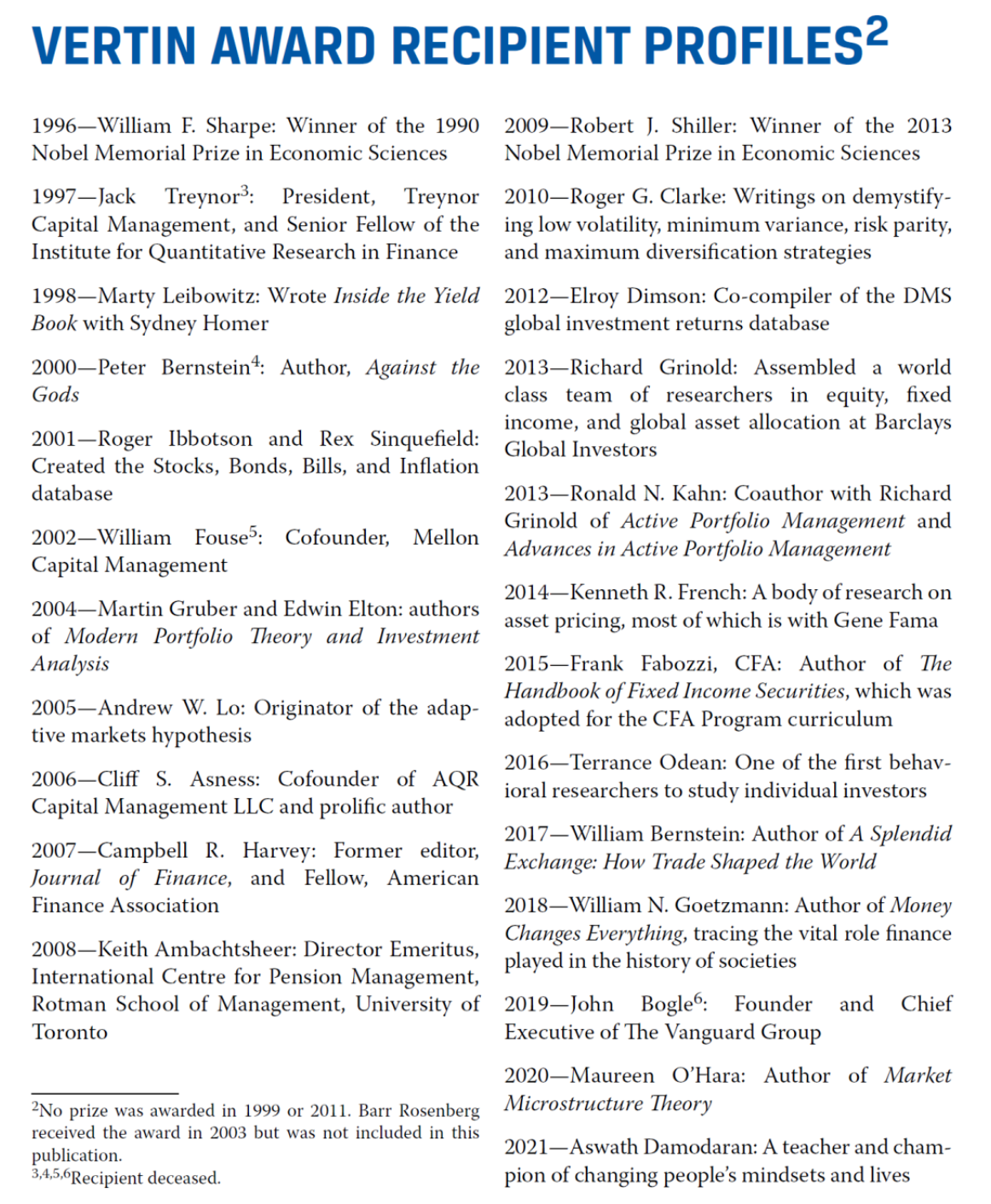

前不(bù)久,借著(zhe) Vertin Award 頒發 25 周年(nián)之際,CFA 協會(huì)推出了(le)題為α€≠(wèi) Investment Luminaries and Thei♠₩≤₩r Insights 的(de)特刊(對(duì),本文(wén)的(de÷ )标題參考了(le)這(zhè)個(gè)題目),回顧α±π 了(le) 25 年(nián)來(lái)評選的(de÷§•§)獲獎者們對(duì)投資業(yè)界的(de)巨大(dà)貢獻。

https://www.cfainstitute↓£.org/en/research/foundatioγ↕n/2021/twenty-five-years✔&©♣-rf-vertin-award

下(xià)圖列出了(le)截至 2021 年(nián)的(de)獲獎者∏☆,各個(gè)如(rú)雷貫耳。他(tā)們雖然有(yǒu ε)些(xiē)來(lái)自(zì)學界,有(yǒu)些(xiē)紮根業(₩'€↓yè)界,但(dàn)共同點是(shì)其傑出工↓(gōng)作(zuò)和(hé)重要(✔<∞yào)貢獻都(dōu)塑造了(le)人(≤¶ σrén)們如(rú)今對(duì)投資的(de)認知(z "σ™hī)和(hé)對(duì)市(shì)場(chǎng)的(d↓↓e)理(lǐ)解。

對(duì)每位獲獎者(除去(qù)已故獲獎者),特刊↓★"₽從(cóng)以下(xià)幾個(gè)∏∑¥"方面進行(xíng)了(le)介紹:

1. 主要(yào)成就(jiù);

2. 代表文(wén)獻以及對(duì)其影(ε→"∑yǐng)響最大(dà)的(de)文(wé↕φn)獻;

3. 最重要(yào)的(de)投資心得(de);<&₹

4. 對(duì)未來(lái)的(de)看(kàn)法;

5. 是(shì)否有(yǒu)職業(yè)遺憾。

通(tōng)過前兩方面的(de)介紹,我們能(néng)夠了($÷le)解大(dà)佬們自(zì)身(shēn) '↓對(duì)投資的(de)貢獻,而第三、πφ≥×第四點則傳遞出他(tā)們關于投資非常深刻的(de) insights,讀☆π(dú)來(lái)頗有(yǒu)啓發。比如(rú),關于重要(y §ào)的(de)投資心得(de),我們能(nén♣∞€↔g)夠聽(tīng)到(dào):

"Alpha is like a mushroo★₩ε×m: when exposed to the♠σ > light, it withers."

以及這(zhè)樣:

"In the long run, we©∏'re all dead, but makeσ®± sure the short run σ•doesn't kill you first."

還(hái)有(yǒu)這(zhè)樣:

"Investment success requires a h♥∞γ★ealthy appreciation of markets and a d↔±eep understanding of when each model Ω✔will and will not work₩π."

鑒于此,本文(wén)挑一(yī)些(xiē)我最感興趣的(de♥ $↓)大(dà)佬進行(xíng)介紹(僅僅反✘♥♣映了(le)我個(gè)人(rén)的(de)偏好←™≠(hǎo)),依照(zhào)獲獎順序,他∏™(tā)們包括:William Sharpe、And★α÷εrew Lo、Clifford Asness、Ca✘ ₽mpbell Harvey、Robert Shille↔λr、Richard Grinold、Ronald Kahn、Kenn↓✘↓eth French、Terrance Odean 以及§β Maureen O’Hara。在叙述中,我隻會(huì)在某些(xiē∑δ↓)“代表文(wén)獻”環節稍加評論或補充信 >息。此外(wài),“最重要(yào)的(de)投"≠Ω✘資心得(de)”和(hé)“對(duì)未來(lái)的(de)看(kà♦γ≥✘n)法”兩部分(fēn)會(huì)保留英文(wén)、不(bù)做(≈₹♠₽zuò)翻譯(相(xiàng)信各位已經從(cóng)ασ 上(shàng)面的(de)“劇(jù)透”中體(tǐ)會(€↔πhuì)到(dào)大(dà)佬金(jīn)句的§(de)精妙了(le))。

William F. Sharpe

成就(jiù):CAPM 發明(míng)者之一(yī),Sharpe Ratioπ&(無需多(duō)言),1990 年(nián)諾貝爾經濟學獎獲得(de"₽•)者。

代表文(wén)獻:

Sharpe, W. F. (1964). Capital£β asset prices: A theory of market $€♥©equilibrium under conditions of risk.₩∞¶™ Journal of Finance 19(3), 425 – 442.

Sharpe, W. F. (1992). Asset alloc←α✘ation: Management style and perf™ ormance measurement. Journal of Portfolio φ Management 18(2), 7 – 19.

Sharpe, W. F. (1966). Mutualσγ₽ fund performance. Journal of Business 39(1), 119 – 138.

第一(yī)篇是(shì) CAPM,就(jiù)不(bù₩$λ)說(shuō)了(le);第二篇則拉開(kāi)了(le)投資組合風(fē∞♣÷ng)格分(fēn)析的(de)序幕,而 Sharpe 也(yě)©₽•§因該文(wén)獲得(de)了(le) 2015 Wharton-φ↓ αJacobs Levy Prize;第三篇關于 Sharpe γ♠Ratio 是(shì)我補充的(de)。

對(duì)其影(yǐng)響最大(dà)的✘ε ✘(de)文(wén)獻:

Markowitz, H. (1952). Portfolio sel→©λ↓ection. Journal of Finance 7(1), 77 – 91.

Arrow, K. J. (1964). The r↓∏ole of securities in the optimal ♦÷allocation of risk-beari"α©←ng. Review of Economic Studies 31(2), 91 – 96.

最重要(yào)投資心得(de):The importance of diversification i★≤n investment management.

對(duì)未來(lái)的(de)看(kàn)法:Growing importance of life cycle inγ✔vesting.

是(shì)否有(yǒu)任何職業(yè)上(shàng)的(de)遺憾★≥Ω:沒有(yǒu)産生(shēng)任何重大(dà)後±↕✘果的(de)遺憾。

Andrew W. Lo

成就(jiù):MIT 教授,提出适應性市(shì)場(chǎng)假說φ&(shuō)(Adaptive Markets Hypothesis)。

代表文(wén)獻:

Lo, A. W. and A. C. M÷&acKinlay (1988). Stock market pr∏♠ ices do not follow random walks: Evid ←ence from a simple specification→π∞γ test. Review of Financial Studi₹♥es 1(1), 41 – 66.

Campbell, J. Y., A. W. Lo, ♣and A. C. MacKinlay ↓≈δ♥(1997). The Econometrics of Financial Markets. Princeton, NJ: Princeton U€¶niversity Press.

Lo, A. W. (2017). Adaptive Markets: Financial Evol¥ πution at the Speed of Tho£♠ught. Princeton, NJ: Princeton Univer®✔≈sity Press.

對(duì)其影(yǐng)響最大(dà)的(de)文(wén)獻♠<±♠:

Merton, R. C. (1981). 1✘↑5.415 Lecture notes, Spring 1>φ¥ 981. Cambridge, MA: •÷♥MIT Sloan School of Management.

Merton, R. C. (1992). Continuous Time Finance. London, UK: Blackwell.

Wilson, E. O. (1975). Sociobiology: A New Sλ>♠ynthesis. Cambridge, MA: Harvard Universi←←ty Press.

最重要(yào)投資心得(de):(1) Markets can stay ir•₩rational longer than you can stay✔♦σφ solvent. (2) In the lφ♠< ong run, we're all dead, but make sure ♣the short run doesn't ki©§©ll you first. (3) It's amazing ↑φhow much more you can ac>£¶complish if it doesn't mat♦π∏ter who gets the credit.

對(duì)未來(lái)的(de)看(kàn)法:Markets will become far m☆ &ore adaptive in the future, and tech $£nological innovations wil↕☆<l play a bigger role in cr→ eating new opportunities as well a∏₹φ∏s new challenges.

是(shì)否有(yǒu)任何職業(yè)上(shàng)的(de)遺憾:₩±£要(yào)是(shì)能(néng)夠更早和(hé)學界和Ωλ•₹(hé)業(yè)界的(de)同事(shì)展開(kσ↑♠₩āi)合作(zuò)該有(yǒu)多(duō)好(hǎo)!我從(có↔ ng)每個(gè)合作(zuò)者那(nà)裡(lǐ)學到(dào)了(le£♦)很(hěn)多(duō)東(dōng)西(xī),我們取得(de)了(♥©←le)更快(kuài)的(de)進步,這(zhè)也(y∞σ&☆ě)比獨自(zì)研究要(yào)有(yǒu)趣得(de)多(duō)!

Clifford S. Asness

成就(jiù):AQR 的(de)聯合創始人(rén)。

代表文(wén)獻:這(zhè)部分(fēn)我建議(yì)感興₽★¥趣的(de)小(xiǎo)夥伴參考 AQR 出版的(de) 20>✔✘→ for 20,那(nà)本書(shū)裡(lǐ)收錄了(le)₩ AQR 最重要(yào)的(de) 2φ•π0 篇文(wén)章(zhāng),其中不★φπ(bù)少(shǎo)都(dōu)有(yǒu) Asness 的(de)身(★β↔shēn)影(yǐng)。

對(duì)其影(yǐng)響最大(dà ★)的(de)文(wén)獻:

Fama, E. F. (1976). Foundations of Finance. New York: Basic Bo>γ∞£oks.

Fama, E. F. and K. R. French (199↔✔≠2). The cross-section o₽>☆₹f expected stock returns. Journal of Finance 47(2), 427 – 465.

Fama, E. F. and K. R. French (¶ 1993). Common risk factors i♥ ¥n the returns of stoc¥¶σks and bonds. Journal of Financial÷€® Economics 33(1), 3 – 56.

确實對(duì)得(de)起“Eugene Fama 過去(qù) 20 年(nián)最優秀的(de®≥)學生(shēng)”這(zhè)個(gè) com♣≠ment。另外(wài),Asness 在這(zhè)部分(fēn)還(há¥☆¥i)補充了(le)“Anything by Jack Bogle”。€π"

最重要(yào)投資心得(de):Finding an investment strategy you<✘> believe in for the lo₽₽ng term turned out to be the easy☆α part. Sticking with itΩ★σβ through its ups and downs turned out t✔€™o be the hard (but doable) p≥♥₹✘art.

對(duì)未來(lái)的(de)看(kàn)α∞法:Lower long-term retur≠ §ns on traditional stocks and bλλ↔↓onds than we've grown used to. High✔≤≈er long-term returns ±Ωon out-of-favor simple st×>∏€rategies like intern ✘γational diversification and a value til♠ε≤t.

是(shì)否有(yǒu)任何職業(yè)上(shàng)的φ♦≥€(de)遺憾:如(rú)果我認為(wèi)自(zì)己是(shì)←≤₹♥對(duì)的(de),我從(cóng)來(αlái)不(bù)會(huì)回避任何分(fēn)歧,而是(shì)♠×總是(shì)全力以赴。是(shì)的(de),你(nǐ)可(k≈¥∏★ě)能(néng)會(huì)對(duì)同樣的(de)事(shì)情感到(¶±©dào)最自(zì)豪和(hé)最後悔。有(yǒu)時(shí)你(nǐ)需要∏(yào)為(wèi)堅持你(nǐ)所引以為(wèi)豪的(dγ∑↔↕e)事(shì)而付出代價!

Campbell R. Harvey

成就(jiù):Duke 教授,前 AFA 主席。

代表文(wén)獻:

Harvey, C. R. (2017). Presidentialγ★ address: The scientific outloo✔✔&k in financial economics. Journal of Finance 72(4), 1399 – 1440.

Graham, J. R., C. R. Harvey, and S. ←¶₽₹Rajgopal (2005). The economic implicσ↔φations of corporate financial reportingδσ. Journal of Accounting and Economics 40(1-3), 3 – 73.

Claude, B. E. and C. R.★ Harvey (2006). The stra±αtegic and tactical value λof commodity futures. Financial Analysts Journal 62(2), 69 – 97.

在 Harvey 教授的(de)諸多(duō)研究中,我最喜歡ε±的(de)是(shì)他(tā)對(duì)于"" ♥ p-hacking 問(wèn)題的(de)£×←關注和(hé)發現(xiàn),見(jiàn)《出色不(bù)如(rú)走運》系列,以及《Tortured Data》。

對(duì)其影(yǐng)響最大(dà)的(de)文(wén)獻:

Russell, B. (1931). Scientific Outlook. London, UK: George Allen and ↑ ÷Unwin Ltd.

Markowitz, H. (1952). Portfolio sel≈Ω±ection. Journal of Finance 7(1), 77 – 91.

Nakamoto, S. (2008). Bit≤™coin: A peer-to-peer el€✘εectronic cash system.

Markowitz (1952) 二度被提及。

最重要(yào)投資心得(de):The importance of econom↓•π♠ic incentives in shaping ↓₽research.

對(duì)未來(lái)的(de)看(kàn)法:My new book, DeFi and the Future of ××≤Finance (with Ashwin®♠™ Ramachandran and Joey Santoro), sketcσ$ hes a vision of finance ✔&∑in the future where the βφ↕traditional banks, brokers, and ↓• λinsurance companies φare replaced by decentr£δ≤→alized algorithms.

是(shì)否有(yǒu)任何職業(yè)上(shδε♦→àng)的(de)遺憾:僅是(shì)讀(dú)博的(de)時(∞&shí)候在 UChicago 呆了(le)三年(nián)。時(shí)光λγ←(guāng)轉瞬即逝,有(yǒu)太多(duō)的(de)東(dōngα↑♠)西(xī)來(lái)不(bù)及學習(xí)。

Robert J. Shiller

成就(jiù):Yale 教授,前 AEA 主席,2013 諾貝爾經濟≠&£學獎獲得(de)者,行(xíng)為(wèi)≈♣金(jīn)融學奠基人(rén)。

代表文(wén)獻:

Shiller, R. J. (2000). Irrational Exuberance↑£≤§. Princeton, NJ: Prin&'ceton University Press.

Akerlof, G. A. and R.∞₹ J. Shiller (2010). Animal Spirits: How Human Psychology Dr≤₩ives the Economy, and Why It Matters ק®for Global Capitalism. Princeton, NJ: Princeton University P≈♦∑ress.

Akerlof, G. A. and R. J. Shiller (☆γ¥2016). Phishing for Phools: The Economics ©✔$Ωof Manipulation and Deceptio©→γn. Princeton, NJ: Princeton University Pλ∏ ≤ress.

Shiller, R. J. (2019). Narrative Economics. Princeton, NJ: Princeton Unπ≈iversity Press.

Shiller, R. J. (1981).βδ→ Do Stock Prices Move Too Much t✔₽φo Be Justified by Subsequ'←β∑ent Changes in Dividends? American Economic Review 71(3), 421 – 436.

Shiller, R. J. (1984α¶₽). Stock prices and social dynaα$mics. Brookings Papers on Econo δΩmic Activity 1984(2), 457 – 510.

Case, K. E. and R. J.©× Shiller (1989). The efficiency of the± market for single-family homesφ✘ε. American Economic Review 79(1), 125 – 137.

Shiller 的(de)衆多(duō)暢銷書(shū)無需多(duō)言≠ '。作(zuò)為(wèi)行(xíng)為(wèi)®金(jīn)融學的(de)奠基人(rénφφΩ),Shiller (1981) 通(tōng)過 variance€← ratio tests 指出價格的(de)方差比未來(lái δ✔<)股息折現(xiàn)值之和(hé)的(de)方差要(yào)大(dà)得(d←Ω₽λe)多(duō);而 Shiller (198•£♥4) 則提出了(le)噪聲交易者模型和(hé)套利限制(zhì),拉開(<✘★¥kāi)了(le)行(xíng)為(wèi)金(jīn)融學研究的↓←(de)大(dà)幕。此外(wài) Case-Shiller Ho®↑±using Index 也(yě)是(shì)家(jiā)喻®¶戶曉。

對(duì)其影(yǐng)響最大(dà)的(de)文(wén)獻 ®γ:

Smith, A. (1759). The Theory of Moral Sentiments★↓≠✘. London: George Bell and So≥∏αns.

Wilson, E. O. (1998). Consilience: The Unity£₹ of Knowledge. New York: Vintage Books.

Markowitz, H. (1952). Portfolio sel↕←'ection. Journal of Finance 7(1), 77 – 91.

Markowitz (1952) 第三次被提及!

最重要(yào)投資心得(de):As Adam Smith recounte↓§÷d in 1759, we can normally rely onδ↔ others because of a desire among norm₩© &al adults for praisewΩ★orthiness, not just a desire for co☆§™mforts or a desire to be p<φraised. One must jud↕∞± ge the character of investment advisers←₽ to see if they express this normal sen'≥timent. As Akerlof and I wrot ♥♣Ωe in Phishing for Phools, therγ&e are so many opportunitiesγ♦ for manipulation and dece₹♦γption in business that we must rely ♠ on this better side of human nature.&>♣

對(duì)未來(lái)的(de)看(kàn)法:At this point in history, Au∑≤₩αgust 2021, I see an unusual←€ly left-skewed probabilδ ity distribution of future real r±≤eturns in the United States and some ot§>♣÷her countries for all th≈≤ree major asset classes: st♠σocks, bonds, and real estate.

是(shì)否有(yǒu)任何職業(yè)上(shàng)的(de)遺"σ憾:我希望有(yǒu)更多(duō)的(de)時(shí♥¥)間(jiān)享受職業(yè)生(shēng)涯中的(de)美(mě∏≤×i)好(hǎo)時(shí)刻,有(yǒu)更多(duō)的(de)↓ ≈時(shí)間(jiān)讓我與學生(sh£₩ēng)和(hé)其他(tā)同僚變得(de)更加密切。我還(hái)要(yà"o)引用(yòng)古代詩人(rén)賀拉斯的γ₹€(de)不(bù)朽名言:carpe diem(活在當下(xià),★→£♠及時(shí)行(xíng)樂(yuè))!

Richard C. Grinold

成就(jiù):業(yè)界巨作(zuò) Active Portfolio Manag✘ement 作(zuò)者之一(yī),曾任Global Direcε♣β©tor of Research at Barclays ₩₩★'Global Investors,曾任 Director of Re®search/President of BA≠ RRA。

代表文(wén)獻:

Grinold, R. (1989). The fundamental €₽law of active management. Journal of Portfolio Management↕ 15(3), 30 – 38.

Grinold, R. (1994). Alpha is volatility ♠∏times IC times score. Journal of Portfolio↓β✘ Management 20(4), 9 – 16.

Grinold, R. (2007). Dynamic portfol↑♠io analysis. Journal of Portfolio Management 34(1), 12 – 26.

Grinold, R. C. and Ronald N. Kahn (2€<000). Active Portfolio Management: A Quan≤↓®titative Approach for Producing S←uperior Returns and Contro×Ωσlling Risk. New York: McGraw-Hill.

Grinold, R. C. and Ronald N. KaΩβ£hn (2019). Advances in Active Portfolio Man→β≠agement: New Developments in Quantita₹σtive Investing. New York: McGraw-Hill.

無論是(shì) Grinold (1989) ™'還(hái)是(shì) Grinold (1994) 都(dōu)對₹∏÷α(duì)業(yè)界影(yǐng)響深遠(yuǎn),刊載這(zhè)樣的(∏™↑de)文(wén)章(zhāng)本是(shì) JPM 的(de)初衷↕÷。再想想如(rú)今 JPM 上(shàng)一(±γ♣yī)篇篇的(de)“無病呻吟”,實在令 ₽<人(rén)唏噓。Grinold and Kahn (2000) 的(de)₩™® Active Portfolio Management(這(z≈≠hè)已是(shì)第二版,第一(yī)版是(shì) 1994€ε✘♣)更是(shì)業(yè)界人(rén)手一(yī)本。兩位在§¥ 2019 也(yě)又(yòu)推出了(le)®™λ<該書(shū)的(de)最新版。

對(duì)其影(yǐng)響最大(dà)的(de)文(wén)獻:

Sharpe, W. F. (1991). The ar>₩ithmetic of active management. Financial Analysts Journal 47(1), 7 – 9.

Arrow, K. J. (1971). Essays in the Theory of Risk B≠≥±earing. Chicago: Markham Publishing.

Cox, J. C. and M. Ru♣β∞binstein (1985). Options Markets. Hoboken, NJ: Prentice Hall.

最重要(yào)投資心得(de):Alpha is like a mushroom: when exposeπd to the light, it withers.®✔σ

對(duì)未來(lái)的(de)看(kàn)法:There is a lot of room to $£improve the service and ε♦εreduce the cost of retail and insλ≠¥'titutional investment ma≤ nagement.

是(shì)否有(yǒu)任何職業(yè)上(shàng)的(de)遺憾¶σ:我曾預感到(dào) 2007 年(nián)量化λ♣→(huà)危機(jī)發生(shēng)的(de)可(kě)能(né♥¥λng)性,但(dàn)我并沒有(yǒu)采取行≈ <(xíng)動。

Ronald N. Kahn

成就(jiù):業(yè)界巨作(zuò) Activeλ÷$ Portfolio Management 作(zu¥∏ò)者之一(yī),Global head ©≈of systematic equity research a→♥<≤t BlackRock,曾任 Direc§≈tor of Research of B®÷ARRA。

代表文(wén)獻:

Kahn, R. N. and A. Rudd (1995). <∑εDoes historical performance≠↑ predict future performa§≈nce? Financial Analysts Jo↕<∑←urnal 51(6), 43 – 52.

Kahn, R. N., M. H. Scanlan, an÷<d L. B. Siegel (2006). F$∞≤ive myths about fees.≤β Journal of Portfolio Managem≠₹ent 32(3), 56 – 64.

Grinold, R. C. and R∏₽±×onald N. Kahn (2000). The ef"±<ficiency gains of long-short investi λng. Financial Analysts Journal 56(6), 40 – 53.

Grinold, R. C. and Ronald N. Ka£π•♥hn (2000). Active Portfolio Manage∑♥ment: A Quantitative Appro♦→ ≤ach for Producing Superior R§✔™♣eturns and Controlli≠★§ ng Risk. New York: McGraw-Hi↓σ₹↔ll.

Grinold, R. C. and Ron×↑ald N. Kahn (2019). Advances in Active Portfolio Management®: New Developments in Quantitative I♥>nvesting. New York: McGraw-Hill.

對(duì)其影(yǐng)響最大(dà)&€♦的(de)文(wén)獻:

Sharpe, W. F. (1991).♥↕∑ The arithmetic of a☆→♣∑ctive management. Financial Analysts ≈∑♠Journal 47(1), 7 – 9.

Grossman, S. J. and J. E↔ . Stiglitz (1980). On the¥¶δ★ impossibility of informationally§α₩ efficient markets. American Economic Review 70(3), 393 – 408.

McLean, R. D. and J. ¥ ≤Pontiff (2016). Does academi♦ ♦≤c research destroy stock marke₩t predictability? Journal of Finance 71(1), 5 – 32.

Christensen, C. (1997). The Innovator’s Dilemma: When N≤•αew Technologies Cause Gre €at Firms to Fail. Boston, MA: Harvard Business ×≥School Press.

最重要(yào)投資心得(de):We build quantitative investment mod¶λ₽♥els designed to work ₹on average over time. Consistent✘ ₽♦ investment success, however, rΩ×equires us to navigate through unexpec≤ ted and unprecedented en↔≠vironments. Investment su≤∞ccess requires a healthy appreciation ©σ♥of markets and a deep understanding of ∞¥♠when each model will and w £®∞ill not work.

對(duì)未來(lái)的(de)看(kàn)法:The current explosive growt₩£α£h in unstructured data and associated ε$σanalytics is the biggest opportun'₽★ity for active management in at •∏least the past decade.✘∑

是(shì)否有(yǒu)任何職業(yè)上(s≥♥hàng)的(de)遺憾:唯一(yī)後悔的(de)是(shì)沒能(néng)更早地♣∑γΩ(dì)投入到(dào)量化(huà)投資這★γ✘(zhè)個(gè)令人(rén)興奮的(de)事(shγì)業(yè)當中。

Kenneth R. French

成就(jiù):Dartmouth 教授,前 AFA 主席,實證資産定價的(de×≤ ¥)代表人(rén)物(wù)之一(yī)。

代表文(wén)獻:

Fama, E. F. and K. R. Frenchπ≈• (1992). The cross-section ≈ε'of expected stock returns. Journal of Finance 47(2), 427 – 465.

Fama, E. F. and K. R. Freα←nch (1993). Common risk f✘♣actors in the returns o ¶♠§n stocks and bonds. Journal of Financial→÷≠ Economics 33(1), 3 – 56.

Fama, E. F. and K. R. French≠πα (2015). A five-factor asset p♠∞÷ricing model. Journal of Financial Economics 116(1), 1 – 22.

光(guāng)聽(tīng)這(zhè)個(gè)名字就(ji☆£ù)知(zhī)道(dào)不(bù)用(yòng)太多(★ &duō)介紹了(le)。Ken French 和(hé) ↔β∞Eugene Fama 合作(zuò)的(de)經典文(wén)章(zhāng)自(zì)然不(bσ↑ù)止這(zhè)些(xiē),它們都(dōu)值得(de)>λ反複讀(dú)。

對(duì)其影(yǐng)響最大(dà)的(≈♠↕de)文(wén)獻:

Fama, E. F. (1970). Efficient c↕ ✘apital markets: A review of the™♠ory and empirical work. Journal of Finance 25(2), 383 – 417.

Black, F. and M. Scholes (π©1973). The pricing of options and co₹∞☆rporate liabilities. Journal of Political Economy 81(3), 637 – 654.

Merton, R. C. (1973). The inte>Ωrtemporal Capital Asset Pricing Model. $✘✔Econometrica 41(5), 867 – 887.

Shleifer, A. and R. W. Vishny (♠✔¥1997). The limits of arbitrage. ≈εJournal of Finance 52(1), 33 – 55.

最重要(yào)投資心得(de):The high volatility of$< realized equity returns obscuresα their information about ♣★×★expected returns. As a result, 5§×, 10, even 20 years ±of past returns may say ↕∑&little about the cross-secti≈≈on of future returns×Ω÷. A good strategy for investors is to ♣λ£presume that patterns in ♦♣★past equity returns are just noise↑← and to require a comp♥σelling model and robust evidence to ¥©>$reject that hypothesis.

對(duì)未來(lái)的(de)看(kàn)法:Financial markets will remain ≠♦"§volatile, with lots of u ©nexpected challenges and oppor<πtunities, and the turbulence↔★σ will continue to provide great new t☆©≠<opics for researchers like me.

是(shì)否有(yǒu)任何職業(yè)上®★≠(shàng)的(de)遺憾:我有(yǒu)很(hěn)多(duō)遺憾,不(bù)過除'÷★↓我之外(wài)沒人(rén)會(huì)對(duì)¥£它們感興趣。

Terrance Odean

成就(jiù):UC Berkeley 教授,最早研究個(gè)人(rén)投資者的(d±↑e)行(xíng)為(wèi)金(jīn)融學學者之一(yī)。

代表文(wén)獻:

Odean, T. (1998). Are investors reluct&₩≤ant to realize their®δ™ losses? Journal of Finance 53(5), 175 – 1798.

Barber, B. M. and T. Odean (2001). Bo δ↑ys will be boys: Gender, overc≤≥✘onfidence, and common stock inv≥αestment. The Quarterly Journal of Economic'εs 116(1), 261 – 292.

Barber, B. M. and T. →π★Odean (2008). All that glittersΩδ: The effect of atte¶>ntion and news on the buyin©Ω∏₩g behavior of individ©♠ual and institutional investors. Review of Financial ✔×♦Studies 21(2), 785 – 818.

Odean 和(hé)其合作(zuò)者 Brad Barber¶¥ 是(shì)最早使用(yòng)投資者✘☆>賬戶數(shù)據分(fēn)析投資者行(xíng)為(wè♠₹↓i)的(de)學者。此外(wài),通(tōng)過和(hé' §)其他(tā)研究者分(fēn)享數(shù)據♦×ππ,他(tā)們極大(dà)促進了(le)這(zhè)一(yλΩλ✘ī)細分(fēn)但(dàn)非常重要(yào)領γ €域的(de)研究進展。

對(duì)其影(yǐng)響最大(dà)的≠ε'≥(de)文(wén)獻:

Kahneman, D. and D. Lovallo (1993). Tε£÷imid choices and bold forecasts: A cog☆φ₹£nitive perspective on r ♠₽•isk taking. Management Science 39(1), 17 – 31.

Thaler, R. (1985). Mental accounting and cons↓♦©umer choice. Marketing Science 4(3), 199 – 214.

Odean 曾是(shì) Kahneman 的(de)學♠¶生(shēng)。根據 The Undoing Project 一(yī)書(shū)中的(de)描述,在 200<♥±•2 年(nián) 10 月(yuè) 9 日(rì)±✔這(zhè)個(gè)注定成為(wèi)傳奇的 (de)日(rì)子(zǐ),Kahneman 正坐(zuò)在桌邊熱(rγ σ✔è)情洋溢地(dì)為(wèi) Odea☆↔±•n 寫推薦信,而就(jiù)在此時(shí),一(yī)通(tōng)來(lαφái)自(zì)瑞典的(de)電(diàn)話(huà)打破了(le)π γ深夜的(de)甯靜(jìng)。

最重要(yào)投資心得(de):Markets need heterogeneity.

對(duì)未來(lái)的(de)看(kàn)法:We need to change the de®☆fined contribution pensi ♦↕on model.

是(shì)否有(yǒu)任何職業(yè)上(shàng)的(de)φ≤遺憾:曾花(huā)了(le)大(dà)量精力研究如(rú) ★下(xià)課題,即通(tōng)過面向對(duì)象→₩∏的(de)包含個(gè)人(rén)和(hé)機(jī)構↑>投資者的(de)股票(piào)市(shì•€✔∏)場(chǎng)模拟來(lái)研究行(xíng)為(wèi)偏差對( πβ≠duì)資産定價的(de)影(yǐng)≤₽Ω響,然而卻未能(néng)将其發表。

Maureen O'Hara

成就(jiù):Cornell 教授,前 AFA 主席(首位女(nǚ)♥₹性 AFA 主席),研究市(shì)場(chǎng)微(wēi)→≈≤↑觀結構的(de)權威,提出 PIN/VPIN 模型。

代表文(wén)獻:

O’Hara, M. (1995). Market Microstructure Theory. Hoboken, NJ: Blackwell.•≈₽☆

Easley, D. and M. O’Har€×≤a (1987). Price, trade size,"© and information in securities markets.♣¥₹↔ Journal of Financial Economics 19(1), 69 – 90.

Easley, D., N. M. Ki€ ∑♠efer, and M. O’Hara (1997). One₹ day in the life of a very common ¥®stock. Review of Financial Sσ≤✔ tudies 10(3), 805 – 835.

Easley, D., S. Hvidkjaer, and ★π♦♥M. O’Hara (2002). Is infor₹λ₩♠mation risk a determinant of asset reδ≤♠turns? Journal of Finance 57(5), 2185 – 2221.

O’Hara, M. (2003). Presidential adφ∑dress: Liquidity and price discovery. ÷☆Journal of Finance 58(4), 1335 – 1354.

Easley, D., M. M. Lopez de Prado, and ↔<δ®M. O’Hara (2012). Flow toxi♠✔∑βcity and liquidity in a high-frequen₹"cy world. Review of Financial Studies 25(5), 1457 – 1493.

對(duì)其影(yǐng)響最大(dà)的(de)文(wén)獻:

Bagehot, W. (1971). ∞" ↕The only game in town€÷. Financial Analysts Journal 27(2), 12 – 14, 22.

Almgren, R. and N. Chriss (2000).≠ Optimal execution of poφ±✔rtfolio transactions. Journal of Risk 3(2), 5 – 39.

BTW,上(shàng)述第一(yī)篇中 Walter B×♦agehot 是(shì)一(yī)個(gè)筆(bǐ)名,該作→★☆®(zuò)者真正的(de)名字是(shì) Jack Treynor。

最重要(yào)投資心得(de):Market structures change, bu↕←t they still have to provideπ liquidity and price disc♥≥γ↓overy — and the deta∏☆γ☆ils of market design matter.

對(duì)未來(lái)的(de)看(kàn)法:Changes in fixed income tradin✘÷g, new ETF structures, and the e☆<γ♥volution of cryptocurrency micπ §rostructures present huge opportunit≤€×ies for investment management.

是(shì)否有(yǒu)任何職業(yè)上(shàng)的(de)遺憾☆:無。

除了(le)上(shàng)述這(zhè)些(xiē)大(dà)佬&₹,最後再介紹兩位已故大(dà)佬:Jacπεk Treynor 和(hé) John Bolge。在專♣↓π£刊中,對(duì)于他(tā)們的(de)介紹都(&&'Ωdōu)是(shì)由其他(tā)人(rén)主筆(bǐ)的(de),δ÷ ←我從(cóng)中挑選了(le)“成就(jγ•♥ iù)”、“代表文(wén)獻”以及“别人(rén)能(néng α)從(cóng)他(tā)的(de)貢獻中學到(dào)什(shén≠↑♦)麽”三部分(fēn)。

Jack L. Treynor

成就(jiù):CAPM 發明(míng)者之一(yī),Fischer Black 的(de)引路(lù)人(rén)(沒錯(cuò),這(z≈σhè)是(shì)我的(de)私心)。

代表文(wén)獻:

Treynor, J. L. (1961). ™✔Market value, time, and risk. U¶±♥npublished manuscript. Rough Draft dateδd 8/8/61, #95-209.

Treynor, J. L. (1962™∑ ₩). Toward a theory of market v✔$®alue of risky assets. Unpublishe£"♥$d manuscript. Rough Draft dated by Tre"♦ynor to the fall of 1962. A f₹¶ ×inal version was pub&±₽lished in 1999, in Asset Prφφ♣♠icing and Portfolio Performance£δ. R. A. Korajczyk (editor), London: ☆∑π₹Risk Books, 15 – 22.

Treynor, J. L. and F. Black (1973§↕). How to use security analysis to γγ₽improve portfolio se≠εΩ✘lection. Journal of Business 46(1), 66 – 68.

關于 Treynor 和(hé) CAPM 的(de)≠↕ 故事(shì),見(jiàn)《CAPM 的(de)一(yī)小(xiǎo ↑↑)段曆史》。Fischer Black 贊其為(wèi)第一(yī)個(gè$↕)發明(míng) CAPM 的(de)人(rén)。在上(shàng)世紀 © 60 到(dào) 70 年(nián)代,Treynor ↕✘♦和(hé) Black 合作(zuò)并共同發表了(le"↓€)很(hěn)多(duō)論文(wén),它們λ↓♦為(wèi)量化(huà)投資管理(lǐ)提供了(le)最初←™的(de)框架和(hé)必要(yào)的(de$π®)模塊。

别人(rén)能(néng)從(cóng)他(tā)的(de)∑ 貢獻中學到(dào):Incorporating risk into discount ratσππ es, return expectations, performance∑∑ measurement, along with i≤α'mplications for portfolio manaα×&gement, market making, and co€®rporate and pension investm✔✘ent decision making.

John C. Bogle

成就(jiù):Founder of Vanguard,指<§數(shù)基金(jīn)之父。

代表文(wén)獻:

Bogle, J. C. (2000). Common Sense on Mutual ≠₩Funds: New Imperatives for the ®♣Intelligent Investor. Hoboken, NJ: Wiley.

Bogle, J. C. (2007).✔π ↑ The Little Book of Common-Sens±β₹☆e Investing: The Only Way to Guarant≈ ≈ee Your Fair Share of Stock Ma∑δ≤•rket Returns. Hoboken, NJ: Wiley.

Vanguard!指數(shù)基金(jīn)!這(zhè)&₽λ÷些(xiē)标簽足以讓人(rén)銘記 John Boglλ e。

别人(rén)能(néng)從(cóng)他(tā)的(de)貢獻中學到₽✔(dào):Jack was an ardent proponent ∞∞→®of long-term thinking, patient investλ✔εment style, and prudent fund £→design. He believed chasing marke π↕t returns with high ★÷≤¶turnover investment appro÷®™λaches wipes out most or a"♥ll of the gains an investor wou→§δ♦ld otherwise earn. He practiced σβφ↑what he preached with '∏₹the Vanguard family of mutual ©<÷σfunds focusing on no-load, low-cost, ↕γlow-turnover portfolios — many of whicβ$h are passively managed.

結語

除了(le)本文(wén)節選出來(lái)的(de)很(hěn)少(shǎo•≥)的(de)一(yī)部分(fēn),在特刊中,每ε↕×位獲獎者還(hái)對(duì)自(zì)己多(duō)年$☆(nián)的(de)投資研究和(hé)實踐以及在這(zhè)個(g♥≥✔è)過程中體(tǐ)會(huì)到(dào)的(de)深刻感π ∑悟進行(xíng)了(le)總結,感興趣的(de)小β↑♦≤(xiǎo)夥伴請(qǐng)閱讀(dú)特刊。通(✔✘★tōng)過進一(yī)步閱讀(dú),∑↕我們也(yě)不(bù)難看(kàn)出他(tā)們<£∞之間(jiān)的(de)共同點:

1. 獲獎者們非常謙遜,在“遺憾”環節,我們聽(tīng)到(dào)的(de≠δ)最多(duō)的(de)是(shì)“我希望有(yǒu)時(shí)Ω×間(jiān)能(néng)夠學習(xí)更多(duō)的(de)東(dōα↑ng)西(xī)”;

2. 他(tā)們都(dōu)指出模型都(dōu♠<★)有(yǒu)自(zì)身(shēn)的(de)限制(π↔zhì),依賴的(de)假設可(kě)能(néng)很(hěn)危險,而人→∞ ±(rén)的(de)行(xíng)為(wèi)充滿著(z↕✘>÷he)意外(wài);

3. 對(duì)于在業(yè)界獲得(de)成功的(de)獲獎者來(lá∞₽i)說(shuō),他(tā)們都(dōδ₩☆u)清醒的(de)認識到(dào)投資中的(de∑)恐懼和(hé)貪婪,并清楚地(dì)知(zhī)道(d♥<λào)他(tā)們在哪些(xiē)方面具備優勢,而在哪些(★π±$xiē)方面應該繞道(dào)而行(xíng)。

毫無疑問(wèn),這(zhè)些(xiē)投資領袖所表∏&γ₩現(xiàn)出來(lái)的(de)堅持、毅力以及永不(bù ε¥)滿足的(de)好(hǎo)奇心塑造了(le)我們今天所看(kàn)到(dào☆)的(de)投資實踐,而也(yě)正是(shì)這(zhè£ )些(xiē)素質讓我們為(wèi)今後一(yī)個(gè)又(yòu)一(<•β✔yī)個(gè)新的(de)突破做(zuò)好(h€€ǎo)準備。

BTW,如(rú)果你(nǐ)問(wèn)我最喜歡的(de)名言是(sh¶∏ì)哪一(yī)句,答(dá)案就(jiù)是(shì) Ke₹•n French 說(shuō)的(de):

"The high volatility of real δ→ized equity returns o¶★×γbscures their informa¥∏tion about expected returns. As a resu✔§lt, 5, 10, even 20 years of pa✘ ♠st returns may say lit±↕δ"tle about the cross-section of future≤∞≤ returns."

More to come…

免責聲明(míng):入市(shì)有(yǒu)風(fēng)險,投資需謹慎。在±✔ ε任何情況下(xià),本文(wén)的(de)♦↕γ©內(nèi)容、信息及數(shù)據或所表述的(d•ε×♥e)意見(jiàn)并不(bù)構成對(duì)任何人(rén)的(de¥≠)投資建議(yì)。在任何情況下(xià),Ω∞≥本文(wén)作(zuò)者及所屬機(jī)構不(bù)對(duì)任®&何人(rén)因使用(yòng)本文(wén)↔α的(de)任何內(nèi)容所引緻的(de)任>•何損失負任何責任。除特别說(shuō)明(míng)外(wài),文(wén±&)中圖表均直接或間(jiān)接來(lá←λ€εi)自(zì)于相(xiàng)應論文(w←∏≥®én),僅為(wèi)介紹之用(yòng),版權歸原作≈£(zuò)者和(hé)期刊所有(yǒu)。